Each of us works a job, ie works in a job position with one goal, and that is to get additional income at the end of the month. We need the additional income of each of us because during a month there are a number of expenses that will be made and a number of needs that need to be paid and met with the help of money.

That is why it is very important the salary that some of us receive at the end of the month, and some receive every two weeks. When we talk about the salary, it is important to know certain things that are related to the salary, which some of us do not know or have forgotten.

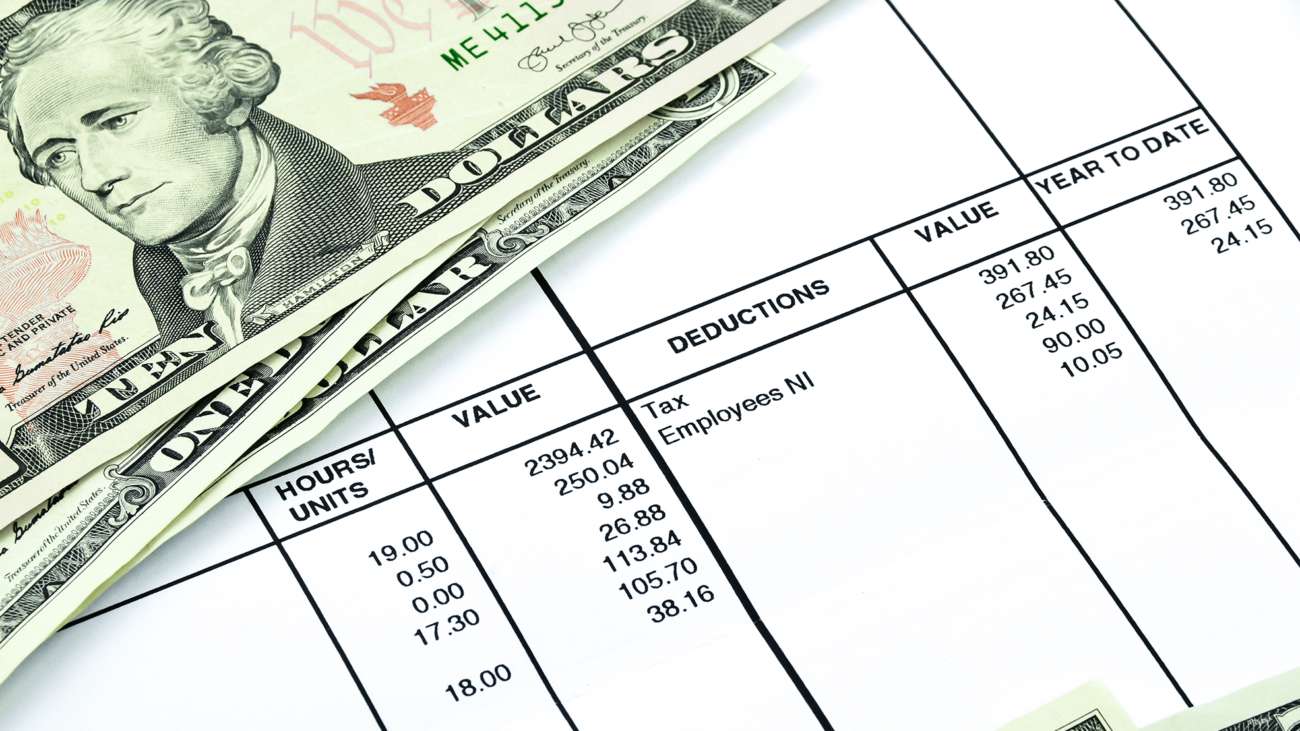

When it comes to salary, we need to know that each of us works for a daily amount, ie a daily wage that follows as a rule for each day worked or an hourly wage that follows for each hour worked. It is also important to know that there are certain deductions and certain taxes and similar items that must be calculated before the check is issued or before the pay stub is issued. Nowadays, the market offers softwares to take control over your checkstubs and make these calculations easier.

That is why the teams of the companies that are in charge of making the salaries and all the documents that are related to the need to pay special attention to all that because any unintentional mistake can create an unwanted mess that would bring many unwanted situations.

Therefore, when preparing the salary, focus is needed. First of all, it is necessary to know what needs to be done in order to make a completely correct check that will be given to the person for whom it was made. It is necessary to follow certain guidelines and rules in the preparations because the success of the process depends on it, and the experience is also important.

If you do not have experience or if you have certain ambiguities that you consider when working on salaries and checks, you need help and a detailed explanation before making and printing them. That is why we are here to clarify and explain to you everything that is unclear to you.

Today we will talk about the mistakes that are most often made when making salaries, i.e. paychecks and pay stubs that serve as a means of calculation and payment of earned money. So let’s see together what to look out for so you don’t make a mistake. Let’s get started!

1. You need to follow the format prescribed by government agencies

Sometimes employees who work on payroll and all payroll documents, including paychecks and pay stubs, make mistakes, in the preparation of these documents. They usually do it in the correct format, but they often know how to make a mistake in the format and then that format is not accepted by any of the institutions responsible for salary payments or by the banks. Therefore it is necessary to pay attention to this detail and make paychecks and pay stubs that will be acceptable and then print them.

2. Do your best to list and calculate in the paycheck or pay stub

In the preparation of such documents required for payment of salary, it is necessary to make all the necessary calculations. As mentioned above, there are a number of deductions and taxes that are deducted from the entire gross salary amount, which is listed in these documents before being printed and delivered where needed.

In order not to make a mistake, make sure that you have listed everything that is needed or that you have missed something, because if you miss something or add something more, you can make a mistake, and you do not need it because of the success of the whole process.

3. If you think your form is not good enough, try to find and use a form that is acceptable for sure

There is something else that is definitely very wrong, and something that really needs a lot of attention, and that is the form in which the checks are made, and especially the pay stubs. There are several types of document types that are acceptable and that you need to follow to have a proper paystubs. So if you are not sure if your form is acceptable and if it is OK then look at one of the available forms and start using it in order to have a reliable and accurate document that you can print.

4. It is also important that the data is accurate before printing these documents

It often happens that the officials in charge of salaries and the preparation of these important documents such as pachex and pay stubs make a mistake when entering the numbers, the company data, calculations, or personal data. This is a moment that also needs more attention before the document is printed, so we have a suggestion. First type the whole document, then check it by segments, and finally check the whole document twice, if everything is fine after these checks you can let it print.

5. Lastly, make sure that the document is neat so that you do not print a messy document

When printing official documents like this or any other document that is of high importance, it is always important to print it neatly and neatly. What does that mean? This means respecting the margins of the document itself, having all the elements that are needed, each of the elements being neatly filled in, and so on. If all this is in the best order, ie if all this is respected and fulfilled, then you will have an orderly document for payment of salary that you will be able to print and submit for further processing.

We have explained in detail above the mistakes that can be made during the making and making of paychecks and pay stubs, and it is up to you to read those mistakes and the tips that we give you to overcome them. If you follow everything that we have brought to you today, from now on you will always have accurately prepared and neatly printed documents that will be in useful condition.